Introduction

Renewable Asset Management Software (RAMS) is a specialized category of enterprise software designed to centralize the technical, operational, and financial management of renewable energy assets—primarily solar, wind, and battery energy storage systems (BESS). These tools act as the “brain” of a renewable energy business, integrating real-time SCADA (Supervisory Control and Data Acquisition) data with financial reporting, contractual compliance, and field service management.

The importance of RAMS cannot be overstated. With energy margins tightening and grid requirements becoming more stringent, asset managers must maximize “availability” and minimize “lost energy.” These tools are used for proactive maintenance, automated investor reporting, and monitoring grid-compliance in real-time. When evaluating a tool, users should look for its ability to handle “noisy” data, the depth of its financial modeling, and how seamlessly it integrates with existing ERPs or CMMS (Computerized Maintenance Management Systems).

Best for: Independent Power Producers (IPPs), large-scale utilities, institutional renewable energy investors, and specialized O&M (Operations & Maintenance) service providers managing multi-technology portfolios across different geographies.

Not ideal for: Residential solar installers or small businesses with a handful of static assets where a simple monitoring app provided by the inverter manufacturer is sufficient and significantly more cost-effective.

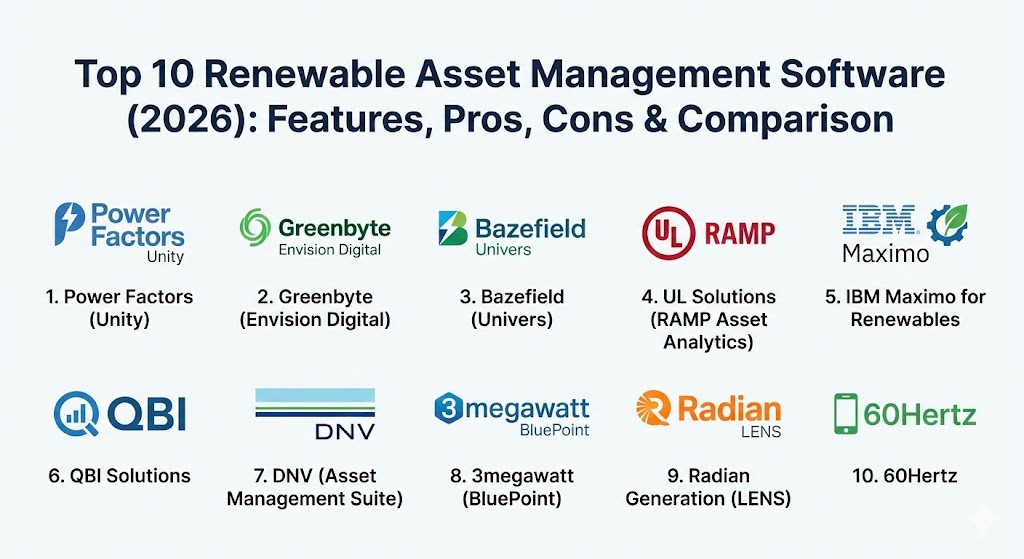

Top 10 Renewable Asset Management Software Tools

1 — Power Factors (Unity)

Power Factors has solidified its position as the market leader in 2026, offering the Unity platform—a comprehensive suite that integrates the technical prowess of its previous acquisitions (like Greenbyte and 3megawatt) into a single, unified multi-cloud solution.

- Key features:

- Unity AI Insights: Predictive models that identify equipment failure before downtime occurs.

- Automated Data Cleaning: Advanced algorithms to filter SCADA noise and fill missing data gaps.

- Integrated Financial Logic: Direct linking of technical performance to P&L statements.

- Mobile Field Response: Tools for technicians to log site visits and inventory in real-time.

- Multi-Technology Support: Native workflows for Wind, Solar, and Energy Storage (BESS).

- Pros:

- Truly all-in-one; eliminates the need for separate technical and financial tools.

- Massive ecosystem with a large library of pre-built connectors for various OEMs.

- Cons:

- The sheer breadth of the platform can make it overwhelming for smaller teams.

- Premium pricing reflects its status as a top-tier enterprise solution.

- Security & compliance: SOC 2 Type II, GDPR, ISO 27001, and NERC-CIP compliant.

- Support & community: Extensive documentation, a dedicated customer success manager for enterprise tiers, and a large global user community.

2 — Greenbyte (Envision Digital)

While now part of a larger ecosystem, the Greenbyte brand remains synonymous with exceptional user experience and high-end data visualization. It is often the preferred choice for technical asset managers who prioritize “at-a-glance” situational awareness.

- Key features:

- Customizable Dashboarding: Drag-and-drop widgets for creating investor-ready views.

- Open API Architecture: Highly flexible for connecting to external business intelligence tools.

- Automated Alarms: Intelligent notification logic based on real-time SCADA thresholds.

- Performance Benchmarking: Compare your assets against regional or global averages.

- “Envision” AI integration for deep-learning performance optimization.

- Pros:

- Renowned for having the most intuitive and modern UI in the renewable sector.

- Very strong at identifying systemic underperformance in wind turbine strings.

- Cons:

- Financial modules are not as deep as dedicated portfolio management tools.

- Integration with non-Envision hardware can sometimes require custom dev work.

- Security & compliance: ISO 27001, SOC 2, and HIPAA (where relevant for smart city integrations).

- Support & community: Excellent onboarding program and a highly responsive technical help desk.

3 — Bazefield (Univers)

Bazefield is the “control room” expert. In 2026, it is the tool of choice for operators who need high-frequency, real-time control and deep OT (Operational Technology) level insights.

- Key features:

- GADS Reporting: Rule-based performance classifications that automate regulatory reporting.

- 2D/3D Asset Plotter: Advanced visualization for historical tag-level analysis.

- Work Order Integration: Automatically triggers tasks in CMMS/ERP based on site events.

- Real-Time Situation Room: Visualizes asset health across global maps with sub-second latency.

- Loss Category Analysis: Detailed breakdown of where every megawatt-hour went.

- Pros:

- Unrivaled real-time monitoring capabilities for mission-critical operations.

- Very robust for managing complex, multi-brand wind turbine fleets.

- Cons:

- The interface can feel more technical/industrial than “business-friendly.”

- Higher learning curve for those coming from a financial rather than engineering background.

- Security & compliance: NERC-CIP, SOC 2, and ISO 27001.

- Support & community: Deep engineering-level support and specialized training certifications.

4 — UL Solutions (RAMP Asset Analytics)

UL Solutions provides RAMP, an analytics-heavy platform that focuses on the “science” of asset performance. It is particularly valued by lenders and independent engineers for its objective performance benchmarking.

- Key features:

- Power Forecasting: Integrated tools for predicting production over the next 24-72 hours.

- Independent KPI Logic: Standardized metrics that are not biased by OEM data reporting.

- Resource Analysis: Comparing ground-measured solar radiation/wind speed to satellite data.

- Health Indexing: A proprietary scoring system to rank assets by mechanical risk.

- Data Normalization: Cleans data from hundreds of different logger brands.

- Pros:

- High credibility with financial institutions during audits or refinancing.

- Excellent for identifying subtle “yaw misalignment” or solar “soiling” losses.

- Cons:

- Less focused on day-to-day “field ticketing” and O&M logistics.

- Not as much focus on automated financial bookkeeping as others.

- Security & compliance: FIPS 140-2, SOC 2, and rigorous data anonymization.

- Support & community: Access to UL’s global network of engineers and technical experts.

5 — IBM Maximo for Renewables

IBM Maximo has adapted its world-class Enterprise Asset Management (EAM) suite specifically for the renewable sector. In 2026, it leverages IBM Watson to provide some of the best predictive maintenance insights on the market.

- Key features:

- Watson AI: Identifies patterns in equipment degradation before they become critical.

- Map-Centric Operations: Manage thousands of geographically dispersed assets via GIS.

- Inventory Optimization: Ensure the right spare parts are in the right warehouse.

- Condition-Based Maintenance: Moves teams away from “calendar” schedules to “need” schedules.

- Integrated EHS (Environment, Health, and Safety) modules.

- Pros:

- The most powerful work-order and inventory management logic available.

- Scalable to the world’s largest utility portfolios.

- Cons:

- Can be incredibly complex to implement and configure.

- Pricing is on the high end of the spectrum.

- Security & compliance: SOC 2, FedRAMP (for government projects), HIPAA, and ISO 27001.

- Support & community: Massive global partner network and 24/7 enterprise-grade support.

6 — QBI Solutions

QBI Solutions is the financial analyst’s best friend. While it handles technical data, its core differentiator is how it manages the “business” of the asset, including SPV (Special Purpose Vehicle) management.

- Key features:

- SPV Budgeting: Integrated modules for cash flow forecasts and debt obligations.

- Investor Reporting: One-click generation of professional, high-level reports.

- Contractual Warranty Support: Uses data to win disputes with OEMs.

- Tax & Accounting Integration: Direct sync with tools like NetSuite or SAP.

- Document Management: Centralized repository for land leases and permits.

- Pros:

- The best tool for managing the “back-office” complexities of a portfolio.

- Simplifies the complex task of managing multiple equity partners and investors.

- Cons:

- Not as strong in real-time “SCADA-level” control room features.

- Technical performance analytics are not as deep as UL or Power Factors.

- Security & compliance: SOC 2 Type II, GDPR, and ISO 27001.

- Support & community: Strong focus on customer success with finance-background support staff.

7 — DNV (Asset Management Suite)

DNV leverages its decades of technical advisory experience to offer software that is deeply rooted in risk modeling and life-cycle assessment.

- Key features:

- Lifecycle Cost Modeling: Predicting total cost of ownership over 25 years.

- Technical Risk Assessment: Identifying structural vulnerabilities in old turbines.

- Resource Assessment Integration: Seamlessly links back to DNV’s industry-leading data sets.

- Regulatory Compliance Tracking: Keeping up with changing grid codes globally.

- Reliability Centered Maintenance (RCM) modules.

- Pros:

- High level of trust for technical due diligence and M&A activities.

- Excellent for assets entering their “end-of-life” or repowering phases.

- Cons:

- Interface can feel legacy compared to cloud-native startups.

- Not designed for high-frequency, real-time intraday trading.

- Security & compliance: ISO 27001, SOC 2, and specialized energy sector certifications.

- Support & community: Access to DNV’s world-renowned advisory and research teams.

8 — 3megawatt (BluePoint)

BluePoint (now an integrated part of the Power Factors ecosystem but still available for specific use cases) is the gold standard for asset management workflow and contractual obligation tracking.

- Key features:

- Obligation Tracking: Never miss a deadline for a land lease payment or tax filing.

- Asset Register: A detailed “family tree” of every component in your fleet.

- Workflow Automation: Standardize how your team handles incoming invoices.

- Technical Performance Summaries: High-level technical KPIs for non-engineers.

- Collaboration Portal: Secure way for external partners to view relevant data.

- Pros:

- Unmatched for organizational hygiene and administrative control.

- Highly structured approach to managing diverse portfolios.

- Cons:

- Limited real-time technical troubleshooting capabilities.

- Some users find the interface to be very “spreadsheet-like.”

- Security & compliance: SOC 2, GDPR, and SSO support.

- Support & community: Very strong documentation and structured onboarding paths.

9 — Radian Generation (LENS)

Radian Generation’s LENS platform is a full-lifecycle asset management solution that emphasizes compliance and operational continuity above all else.

- Key features:

- Compliance Calendar: Mapping out every regulatory and contractual requirement.

- O&M Oversight: Tools to monitor the performance of third-party contractors.

- Incident Management: Tracking safety issues and equipment failures in one place.

- Financial Performance Tracking: Linking production to revenue streams.

- NERC/FERC compliance automation.

- Pros:

- Built by asset managers for asset managers; very practical feature set.

- Strong focus on risk mitigation for large, publicly traded companies.

- Cons:

- Analytics engine is less “AI-forward” than competitors like Power Factors.

- UI is functional but lacks some of the modern design flourishes of Greenbyte.

- Security & compliance: SOC 2, NERC-CIP, and rigorous data protection protocols.

- Support & community: Known for high-touch service and industry expertise.

10 — 60Hertz

60Hertz is a specialized mobile-first platform designed specifically for the “front line”—the technicians in remote areas who have limited internet connectivity.

- Key features:

- Offline-First App: Sync data once the technician returns to a 4G/Wi-Fi zone.

- Photo & Video Evidence: Capture high-res evidence for warranty claims.

- Low-Literacy Interface: Visual-first design to accommodate global labor forces.

- Custom Maintenance Checklists: Tailored to specific hardware types.

- Audit Trails: Verifying that a technician was actually on-site.

- Pros:

- The best tool for field operations in remote or developing markets.

- Drastically improves the quality of data coming from the field.

- Cons:

- Not a full “back-office” portfolio management tool.

- Needs to be integrated with a master RAMS for full portfolio visibility.

- Security & compliance: AES-256 encryption and SOC 2.

- Support & community: Excellent training for field teams and remote troubleshooting support.

Comparison Table

| Tool Name | Best For | Platform(s) Supported | Standout Feature | Rating (Gartner/TrueReview) |

| Power Factors | Enterprise Portfolios | Cloud (SaaS) | Unity AI Insights | 4.8 / 5 |

| Greenbyte | Technical Visualization | Cloud (SaaS) | Exceptional UX/UI | 4.7 / 5 |

| Bazefield | Real-time Control Rooms | On-Prem / Cloud | GADS Reporting | 4.6 / 5 |

| UL RAMP | Benchmarking / Analytics | Cloud (SaaS) | Independent KPI Logic | 4.5 / 5 |

| IBM Maximo | Massive Asset EAM | Hybrid Cloud | Watson Predictive AI | 4.4 / 5 |

| QBI Solutions | Financial Management | Cloud (SaaS) | SPV Budgeting | 4.6 / 5 |

| DNV | Risk / Life-cycle | Cloud / Desktop | Cost Modeling | 4.3 / 5 |

| 3megawatt | Contractual Compliance | Cloud (SaaS) | Obligation Tracking | 4.5 / 5 |

| Radian LENS | Compliance / O&M | Cloud (SaaS) | NERC/FERC Automation | 4.4 / 5 |

| 60Hertz | Remote Field Work | Mobile (iOS/Android) | Offline-First Sync | 4.7 / 5 |

Evaluation & Scoring of Renewable Asset Management Software

| Category | Weight | Evaluation Criteria |

| Core Features | 25% | Multi-tech support, technical depth, and AI-driven predictive insights. |

| Ease of Use | 15% | Dashboard intuitiveness and mobile accessibility for field teams. |

| Integrations | 15% | API availability and pre-built connectors for ERPs and SCADA. |

| Security | 10% | NERC-CIP compliance, encryption, and SOC 2 certifications. |

| Performance | 10% | Real-time data latency and high-volume data handling stability. |

| Support | 10% | Quality of documentation and responsiveness of technical teams. |

| Price / Value | 15% | ROI provided through reduced downtime and administrative hours. |

Which Renewable Asset Management Tool Is Right for You?

Selecting the right platform depends on whether your organization is focused on the “nuts and bolts” of the assets or the “dollars and cents” of the investment.

- Solo Users vs SMBs: If you manage a handful of sites, avoid the enterprise-scale tools like IBM or Power Factors. A modular tool like JSCAPE or even a high-end inverter monitoring portal may suffice. If you have a small commercial portfolio, 60Hertz is great for field-heavy teams.

- Mid-Market IPPs: If your focus is growing a portfolio for sale or refinancing, UL RAMP or QBI Solutions will provide the credibility and financial clarity required by investors.

- Global Enterprises & Utilities: You need a “single source of truth.” Power Factors or IBM Maximo are the only solutions with the scale to handle thousands of assets globally while integrating with your existing corporate ERP.

- Focus on Real-Time Trading: If your business model relies on participating in intraday markets or frequent curtailment adjustments, Bazefield is the logical choice due to its superior real-time OT capabilities.

- Compliance First: For those in high-regulation markets like North America, Radian Generation or Power Factors offer the most robust NERC-CIP and FERC reporting frameworks.

Frequently Asked Questions (FAQs)

1. What is the difference between SCADA and Asset Management Software? SCADA is for real-time control of individual machines (e.g., stopping a turbine). Asset Management Software sits above SCADA, aggregating data from multiple sites to look at long-term trends and financial performance.

2. Can these tools manage hybrid assets (Solar + Wind + Battery)? Yes, most top-tier platforms like Power Factors and Greenbyte are specifically designed to manage hybrid “energy hubs” with a unified dashboard.

3. Do I need an internet connection at the site to use these tools? While data ingestion requires a connection, field-specific tools like 60Hertz allow technicians to work offline and sync their data later.

4. How does AI improve asset management? AI can identify “invisible” losses, such as a wind turbine that is slightly misaligned with the wind or a solar panel that has a specific heat signature indicating a micro-crack before it fails.

5. Can I integrate these tools with my existing accounting software? Yes, tools like QBI Solutions and 3megawatt offer native integrations with SAP, NetSuite, and Microsoft Dynamics to automate financial reporting.

6. Is my data secure in the cloud? Most leading providers use military-grade encryption and are SOC 2 compliant. However, for utility-scale projects, you must ensure the provider meets NERC-CIP requirements for critical infrastructure.

7. Does the software include power price forecasting? Some do. UL RAMP and Bazefield have modules that integrate market price feeds with production forecasts to help optimize revenue.

8. Can I manage sub-contractors through these platforms? Yes. Radian LENS and Power Factors allow you to assign tickets to third-party O&M providers and track their performance against contractual SLAs.

9. How long is the typical implementation time? For a mid-sized portfolio, expect 3 to 6 months. Large utility implementations can take a year or more to fully integrate with all legacy hardware.

10. Do these tools help with warranty claims? Absolutely. By providing an “unbiased” record of downtime and underperformance, these tools are essential for proving to OEMs that equipment didn’t meet its guaranteed availability.

Conclusion

The “best” renewable asset management software in 2026 is no longer just a luxury—it is a prerequisite for a profitable energy business. As we move into an era of high-concurrency data and complex energy markets, the ability to centralize technical and financial intelligence is the only way to ensure long-term ROI. Whether you prioritize the predictive AI of Power Factors, the visualization of Greenbyte, or the financial depth of QBI, choose a tool that can scale with the ambitious growth of your clean energy portfolio.