Introduction

Rail Operations Management Software is a suite of integrated digital tools designed to plan, schedule, monitor, and optimize every aspect of a rail network. These platforms serve as a centralized source of truth, connecting dispatchers, train crews, maintenance teams, and station staff. By leveraging real-time data, these systems manage everything from timetabling and crew rostering to rolling stock maintenance and emergency response coordination.

The importance of these tools lies in their ability to maximize capacity and safety on existing infrastructure. In an industry where a five-minute delay can cascade into a city-wide gridlock, these platforms provide the predictive insights needed to prevent bottlenecks before they occur. Key real-world use cases include automated conflict detection (preventing two trains from vying for the same track segment), predictive maintenance for locomotives, and real-time passenger information updates. When evaluating these tools, users should prioritize interoperability with legacy signaling systems, the robustness of their mobile interfaces, and the ability to scale across diverse geographic regions.

Best for: National railway operators, urban metro and light rail authorities, private freight companies, and multi-modal logistics providers. It is essential for operations managers, transit planners, and safety compliance officers who need to manage high-frequency or high-volume rail corridors.

Not ideal for: Localized short-line heritage railways with minimal rolling stock, or general trucking logistics firms that do not interact with the rail network. Smaller entities may find the complexity and implementation costs of these enterprise suites to be prohibitive.

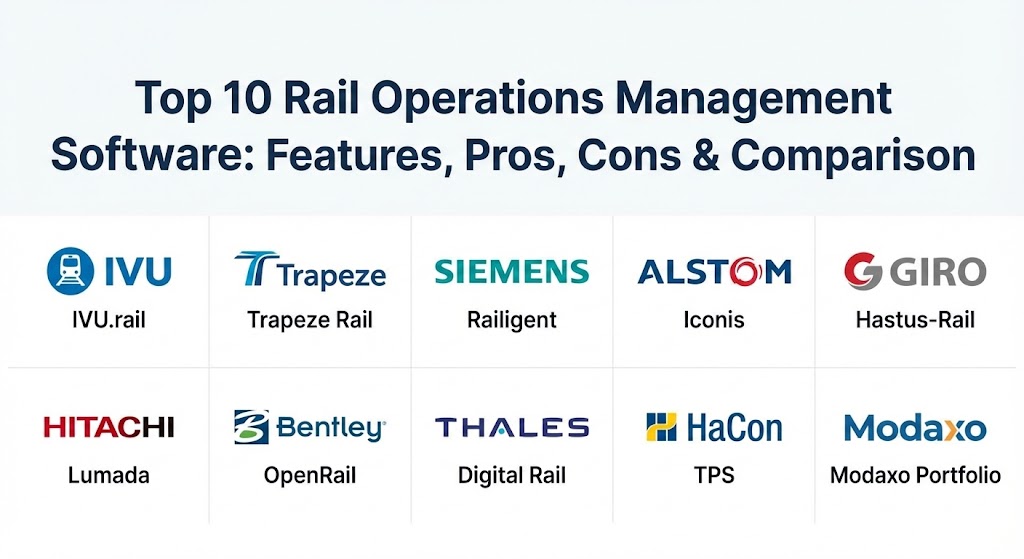

Top 10 Rail Operations Management Software Tools

1 — IVU.rail (by IVU Traffic Technologies)

IVU.rail is a globally recognized, integrated platform designed specifically for the requirements of railway companies. It handles the entire operational process, from initial planning and dispatching to mobile employee portals.

- Key features:

- Integrated resource planning for both vehicles and personnel.

- Automated scheduling and duty rostering with optimization algorithms.

- Real-time vehicle tracking and dispatching cockpit.

- Mobile app for train crews to view rosters and swap shifts.

- Conflict detection and resolution for track usage.

- Integration with passenger information systems.

- Management of workshop and maintenance cycles.

- Pros:

- Highly integrated nature means data flows seamlessly from planning to actual operations.

- Excellent support for complex European railway regulations and multi-country operations.

- Cons:

- The user interface is professional and deep but can be intimidating for new users.

- Requires a significant initial investment in data migration and configuration.

- Security & compliance: ISO 27001 certified, GDPR compliant, support for SSO (Single Sign-On), and role-based access control (RBAC).

- Support & community: Offers a structured “IVU Academy” for training; provides 24/7 enterprise support and holds regular user group conferences.

2 — Trapeze Rail (by Trapeze Group)

Trapeze Group offers a robust suite of rail solutions focused heavily on urban transit authorities. Their software is designed to manage the unique challenges of high-frequency metro and light rail networks.

- Key features:

- Enterprise Asset Management (EAM) tailored for rolling stock and track.

- Intelligent crew management with fatigue monitoring.

- Real-time incident management and reporting.

- Automated block and run cutting for timetables.

- Integrated yard management for vehicle positioning.

- Passenger demand forecasting and capacity planning.

- Mobile maintenance work orders for field crews.

- Pros:

- Strong focus on “human factors,” specifically managing crew fatigue and safety.

- Strong presence in North America and the UK, with localized compliance features.

- Cons:

- Modular nature means costs can add up as you add more functionality.

- Some legacy components may require modernization for a true cloud-native experience.

- Security & compliance: SOC 2 compliant, support for FIPS 140-2 encryption standards, and HIPAA-ready (where relevant to employee health data).

- Support & community: High-quality documentation and a dedicated customer success portal with a strong global community of transit professionals.

3 — Siemens Mobility Railigent

Railigent is Siemens’ data-driven platform that focuses on “Application Suite” management. It leverages IoT and big data to improve the availability of rail assets and optimize operations.

- Key features:

- Predictive maintenance based on real-time sensor data.

- Energy management and optimization for electric rolling stock.

- Digital twin technology for simulating operational changes.

- Smart monitoring of track infrastructure and signaling.

- Automated spare parts logistics and workshop management.

- Open ecosystem for third-party application integration.

- Pros:

- Unrivaled in predictive analytics; significantly reduces unplanned downtime.

- Leverages Siemens’ deep hardware expertise for better data accuracy.

- Cons:

- Heavy focus on assets; may require a separate tool for crew and duty management.

- Optimized for Siemens hardware, though it is increasingly vendor-agnostic.

- Security & compliance: IEC 62443 (industrial cybersecurity), ISO 27001, and GDPR compliant.

- Support & community: World-class enterprise support; extensive training via Siemens Learning Campus.

4 — Alstom Iconis

Iconis is an advanced Integrated Control and Information Center (ICONIS) solution. It focuses on the “Command and Control” aspect, integrating signaling, traffic management, and infrastructure monitoring.

- Key features:

- Advanced Traffic Management System (TMS) with automated conflict resolution.

- Integration of mainline and urban signaling (CBTC, ERTMS).

- Centralized SCADA for power and environmental controls.

- Real-time passenger information dissemination.

- Disaster recovery and emergency management workflows.

- Cybersecurity-hardened architecture for critical infrastructure.

- Pros:

- Excellent for large-scale “nerve center” deployments requiring high reliability.

- Highly customizable to the specific geography and signaling of a network.

- Cons:

- Extremely complex implementation that usually requires Alstom’s direct engineering.

- Not a standalone “off-the-shelf” software; deeply tied to physical infrastructure.

- Security & compliance: Complies with highest railway safety standards (SIL2/SIL4), ISO 27001, and NIS directive.

- Support & community: Direct engineering support and formal operational training programs for dispatchers.

5 — GIRO Hastus-Rail

Hastus-Rail is a specialized software solution for the planning and management of rail operations. It is globally recognized as the benchmark for scheduling and crew rostering in the transit industry.

- Key features:

- Mathematical optimization for train scheduling and block planning.

- Dynamic crew bidding and rostering systems.

- Daily operations management and service adjustment tools.

- Self-service mobile portal for employees.

- Long-term capacity and workforce planning.

- Powerful analytics for operational performance tracking.

- Pros:

- The optimization algorithms are considered some of the best in the industry for reducing costs.

- Very high user satisfaction regarding the flexibility of crew management.

- Cons:

- Focuses primarily on planning and crew; lacks deep infrastructure maintenance tools.

- Interface can feel slightly more “spreadsheet-like” than modern web-based apps.

- Security & compliance: SOC 2 Type II, GDPR, and SSO support.

- Support & community: Very strong user community (GIRO User Group); excellent technical documentation and onboarding.

6 — Hitachi Rail Lumada (Service & Inspection)

Hitachi Rail has integrated its rail expertise with the Lumada IoT platform. Their software focuses on the digital lifecycle of rail assets, using AI to drive operational efficiency.

- Key features:

- AI-powered video inspection for track and overhead lines.

- Rolling stock health monitoring and predictive alerts.

- Smart station management for passenger flow.

- Fleet telematics and real-time location tracking.

- Digital asset lifecycle management.

- Cloud-native architecture for rapid scaling.

- Pros:

- Leader in using computer vision and AI for infrastructure inspection.

- Modern, clean UI that integrates well with other Lumada business products.

- Cons:

- The “operations” side is newer than their traditional engineering components.

- Requires a robust network of sensors and IoT devices to be truly effective.

- Security & compliance: ISO 27001, SOC 2, and adherence to various regional safety standards.

- Support & community: Growing community; leverages Hitachi’s global IT support infrastructure.

7 — Bentley OpenRail

Bentley Systems provides OpenRail, which focuses on the “Digital Twin” and Asset Lifecycle of rail infrastructure. It is less about daily crew scheduling and more about the management of the physical network.

- Key features:

- High-fidelity digital twin modeling of tracks, bridges, and tunnels.

- Integration with GIS and surveying data.

- Asset performance modeling for long-term capital planning.

- Construction and maintenance project management.

- Operational data overlay on 3D models.

- Collaborative environment for multi-disciplinary teams.

- Pros:

- The absolute gold standard for infrastructure modeling and engineering.

- Essential for managing the transition from construction to operations.

- Cons:

- Not a daily “train dispatching” tool in the traditional sense.

- Very high technical requirements for hardware and user expertise.

- Security & compliance: ISO 27001, SOC 2, and support for open data standards (BIM).

- Support & community: Extensive training via Bentley Institute; large community of civil and rail engineers.

8 — Thales Digital Rail Solutions

Thales focuses on the digitalization of signaling and operational control. Their software solutions are designed to increase the density and safety of existing rail lines.

- Key features:

- SelTrac CBTC integration for urban rail.

- Digital signaling and interlocking management.

- Real-time traffic management for high-capacity lines.

- Integrated cybersecurity monitoring for rail assets.

- Passenger density monitoring and station management.

- Connectivity solutions for on-train communication.

- Pros:

- Deep expertise in the world’s busiest metro systems (London, Singapore, etc.).

- Unparalleled security focus, drawing from their defense industry background.

- Cons:

- Highly proprietary ecosystem; works best when Thales hardware is present.

- Can be difficult to implement for smaller, less-complex networks.

- Security & compliance: ISO 27001, IEC 62443, and military-grade encryption standards.

- Support & community: Direct enterprise-level support with a focus on mission-critical uptime.

9 — HaCon TPS (Train Planning System)

HaCon, a Siemens company, provides the Train Planning System (TPS). It is a specialized tool for timetabling and capacity management, used by many national railways.

- Key features:

- Microscopic and macroscopic network modeling.

- Slot management and track allocation for freight/passenger mix.

- Long-term timetable construction and simulation.

- Real-time dispatching and disruption management.

- Customer-facing journey planning integration.

- Capacity analysis for future infrastructure investments.

- Pros:

- Exceptional at managing the complex mix of slow freight and high-speed passenger rail.

- Used by major operators like Deutsche Bahn, proving its reliability at scale.

- Cons:

- Very specialized; requires other tools for crew and asset maintenance.

- Steep learning curve for planners and schedulers.

- Security & compliance: ISO 27001 and GDPR compliant.

- Support & community: Strong European user base; part of the broader Siemens Mobility support ecosystem.

10 — Modaxo (Signature Rail & Others)

Modaxo is an umbrella organization that owns several specialized rail brands like Signature Rail. They offer a diverse portfolio of software covering everything from scheduling to passenger info.

- Key features:

- Signature Rail “Personal Trax” for crew management.

- Real-time vehicle health monitoring.

- Automated timetable optimization.

- Mobile portals for staff and passengers.

- Ticketing and revenue management integrations.

- Scalable solutions for both small and large transit agencies.

- Pros:

- Access to a wide range of specialized tools under one corporate umbrella.

- Focuses heavily on the “passenger experience” and “mobility-as-a-service.”

- Cons:

- The portfolio can feel fragmented; users must choose the right brand for their needs.

- Support quality can vary slightly between different brand entities.

- Security & compliance: Varies by specific product; generally follows SOC 2 and GDPR.

- Support & community: Benefits from Modaxo’s large global presence and transit-specific expertise.

Comparison Table

| Tool Name | Best For | Platform(s) Supported | Standout Feature | Rating (TrueReviewnow.com) |

| IVU.rail | Integrated Resource Mgmt | Windows, Web, Mobile | Unified vehicle & crew flow | 4.7 / 5 |

| Trapeze Rail | Urban Transit / Crew | Web, Mobile, Cloud | Fatigue Monitoring AI | 4.5 / 5 |

| Siemens Railigent | Predictive Maintenance | Web, Cloud | IoT-driven health alerts | 4.8 / 5 |

| Alstom Iconis | Traffic Management (TMS) | On-Premise, Linux | SIL4 Safety Integrity | 4.4 / 5 |

| GIRO Hastus-Rail | Scheduling Optimization | Windows, Web | Industry-lead scheduling | 4.6 / 5 |

| Hitachi Lumada | AI Infrastructure Inspect | Cloud, Mobile | Computer Vision Track Insp. | 4.5 / 5 |

| Bentley OpenRail | Digital Twins / Asset Life | Windows, Cloud | 3D Infrastructure Modeling | 4.7 / 5 |

| Thales Digital Rail | Signaling / Safety | On-Premise, Secure Cloud | Cyber-hardened Signalling | 4.3 / 5 |

| HaCon TPS | Capacity Planning | Windows, Web | High-speed/Freight mix | 4.6 / 5 |

| Modaxo Portfolio | General Transit Mgmt | Web, Mobile, SaaS | Broad Mobility Ecosystem | 4.2 / 5 |

Evaluation & Scoring of Rail Operations Management Software

Choosing a rail management platform requires balancing technical performance with the “human” side of operations—the dispatchers and crews who use the system daily.

| Category | Weight | Evaluation Criteria |

| Core Features | 25% | Scheduling, crew management, asset maintenance, and conflict detection. |

| Ease of Use | 15% | Intuitiveness of the dispatcher cockpit and the mobile crew app. |

| Integrations | 15% | Ability to interface with GIS, signaling hardware, and ERP systems. |

| Security & Compliance | 10% | Safety integrity levels (SIL), GDPR, and industrial cybersecurity standards. |

| Performance | 10% | Real-time data processing speed and system uptime reliability. |

| Support & Community | 10% | Documentation, training academy, and frequency of updates. |

| Price / Value | 15% | Total cost of ownership vs. capacity gains and reduction in downtime. |

Which Rail Operations Management Software Tool Is Right for You?

Solo/Small Private Freight vs. Transit Authorities

If you are a smaller private operator or a freight logistics hub, you likely do not need a full TMS like Alstom Iconis. A more modular approach, focusing on asset tracking and maintenance (like Hitachi Lumada) or simple scheduling (like Modaxo), will provide the best ROI. For large urban transit authorities, Trapeze Rail or GIRO Hastus are the proven leaders for managing high-frequency metro lines.

Budget-Conscious vs. Premium Enterprise

Budget-conscious operators should look for SaaS-based modules that can be added incrementally. Modaxo and some Trapeze modules allow for this. However, for national railways where downtime costs millions per hour, a premium, integrated suite like IVU.rail or HaCon TPS is a necessary investment that pays for itself through optimized track usage.

Feature Depth vs. Ease of Use

If your primary pain point is “planning and scheduling,” GIRO Hastus offers the deepest mathematical optimization. If your pain point is “operational safety and signaling,” Thales or Alstom provide the necessary mission-critical depth. For a balance of ease of use and modern UI, IVU.rail and Hitachi Lumada lead the way.

Security and Scalability

National operators must prioritize SIL (Safety Integrity Level) compliance and cybersecurity. Thales and Siemens have the most robust security frameworks. For scalability across a large geographic area with diverse assets, Bentley OpenRail provides the infrastructure-level visibility needed to manage a national network.

Frequently Asked Questions (FAQs)

1. What is the difference between TMS and RMS?

A Traffic Management System (TMS) focuses on the real-time movement and safety of trains on the track. Rail Operations Management (RMS) is a broader term that includes TMS plus crew rostering, asset maintenance, and passenger information.

2. Can these tools handle both freight and passenger rail?

Yes, but some are better than others. HaCon TPS and IVU.rail are particularly strong at managing the “mix” of different train speeds and priorities on a shared national network.

3. Does this software work with legacy signaling systems?

Most modern systems are designed to be “overlay” platforms that can interface with legacy interlocking via specialized gateways, though full integration is often a major part of the implementation project.

4. How does “Predictive Maintenance” actually work?

Software like Siemens Railigent collects data from thousands of sensors on the train (temperature, vibration, power). AI then analyzes this to predict when a component like a bearing or motor is likely to fail before it happens.

5. What is “Conflict Detection”?

It is a real-time feature that alerts dispatchers if a proposed timetable change or a delay will cause two trains to require the same track segment simultaneously, allowing for proactive re-routing.

6. Is cloud-based software safe for rail operations?

While many planning features are now cloud-based (SaaS), real-time “Command and Control” is often kept on-premise or in highly secure private clouds to ensure safety and low latency.

7. Can crews swap shifts within the software?

Yes, tools like Trapeze and IVU.rail have mobile portals where crews can view their rosters, request time off, and swap duties with colleagues, all while adhering to labor laws and safety rest requirements.

8. How long does implementation take?

For a large urban transit system or national railway, implementation can take anywhere from 12 to 36 months, involving significant data modeling and staff training.

9. What is a “Digital Twin” in rail?

A digital twin (offered by Bentley) is a 3D digital replica of the physical track and assets. It allows operators to simulate the impact of new trains or track repairs in a virtual environment before making changes in the real world.

10. Do these tools help with energy efficiency?

Absolutely. Many systems (like Siemens and Alstom) include “Driver Advisory Systems” (DAS) that tell the driver exactly when to coast or accelerate to minimize power consumption while staying on schedule.

Conclusion

The “best” rail operations management tool is the one that bridges the gap between your physical track and your digital goals. Whether you are looking for the absolute precision of GIRO Hastus for scheduling, the asset-level intelligence of Siemens Railigent, or the infrastructure modeling of Bentley OpenRail, the market today offers specialized solutions for every niche. When choosing, remember that rail is a legacy industry; the most successful software is the one that honors that legacy while providing a clear path to a high-speed, data-driven future.