Introduction

Revenue Recognition Software is a specialized financial tool designed to automate the complex accounting processes required to comply with international standards, specifically ASC 606 and IFRS 15. These standards dictate a rigorous five-step model for recognizing revenue: identifying the contract, identifying performance obligations, determining the transaction price, allocating that price, and finally, recognizing the revenue as obligations are met. Manually managing this across thousands of customers using spreadsheets is not only prone to error but is an invitation for audit failure.

The importance of these tools lies in their ability to bridge the gap between sales activity and financial reporting. Key real-world use cases include managing “unearned revenue” for annual subscriptions, handling mid-month plan upgrades or downgrades, and accurately splitting revenue between a physical product and its accompanying software service. When evaluating a RevRec solution, users should look for strong automation of “contract liability” accounts, deep integration with CRM and ERP systems, robust audit trails, and the ability to handle multi-currency global operations.

Best for: CFOs, Controllers, and Revenue Operations (RevOps) teams in high-growth SaaS companies, telecommunications, and any enterprise dealing with complex, multi-element contracts or recurring billing models.

Not ideal for: Small “mom-and-pop” retail shops or businesses that deal exclusively with simple, one-time point-of-sale transactions where revenue is recognized immediately upon payment.

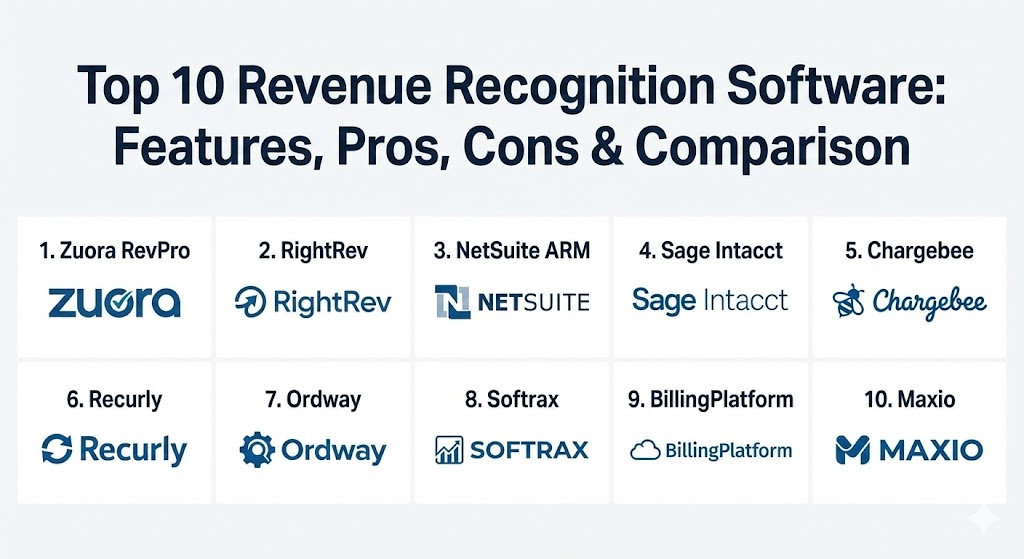

Top 10 Revenue Recognition Software Tools

1 — Zuora RevPro

Zuora RevPro is a market leader in the revenue automation space, designed to handle the most complex revenue scenarios for large-scale enterprises. It acts as a sophisticated engine that sits between your billing system and your general ledger.

- Key features:

- Automated transition to and compliance with ASC 606 and IFRS 15.

- Real-time revenue dashboards for forecasting and historical analysis.

- Flexible configuration for bundled products and multi-element arrangements.

- Sophisticated “SSP” (Standalone Selling Price) calculator.

- Automated dual-book reporting for companies transitioning between standards.

- Deep integration capabilities with major ERPs like Oracle, SAP, and NetSuite.

- Pros:

- Handles extreme volumes of data without performance degradation.

- One of the most mature engines for complex contract modifications and “true-ups.”

- Cons:

- The implementation process is notoriously long and requires specialized consultants.

- The user interface can feel overly technical and dated compared to newer SaaS-native apps.

- Security & compliance: SOC 1 & 2 Type II, GDPR, PCI DSS Level 1, and ISO 27001. Features robust SSO and field-level encryption.

- Support & community: Extensive enterprise-grade support with dedicated account managers; active user community and “Zuora University” for formal training.

2 — RightRev

RightRev is a modern, high-growth revenue recognition platform that focuses heavily on the “Quote-to-Revenue” lifecycle. It is particularly well-known for its seamless, native integration within the Salesforce ecosystem.

- Key features:

- Native Salesforce integration, allowing for revenue visibility directly on the opportunity record.

- Automated performance obligation (POB) identification and price allocation.

- Support for high-volume usage-based billing and hybrid models.

- Automated contract modification handling (upgrades, renewals, and cancellations).

- Comprehensive audit logs that track every change to a revenue schedule.

- Robust reporting for deferred revenue and unbilled receivables.

- Pros:

- Much faster implementation time than legacy enterprise tools.

- Very intuitive UI that feels familiar to any Salesforce or modern SaaS user.

- Cons:

- While it supports other ERPs, its primary strength and feature set are optimized for Salesforce users.

- Advanced forecasting features are still evolving compared to older competitors.

- Security & compliance: SOC 2 Type II, GDPR, and CCPA compliant. Uses modern TLS encryption for all data in transit.

- Support & community: Highly praised for its responsive, “white-glove” customer support; growing documentation library and webinars.

3 — NetSuite Advanced Revenue Management (ARM)

NetSuite ARM is the specialized module within the world’s leading cloud ERP. It is the gold standard for mid-market and enterprise companies that want their revenue recognition to be a native part of their accounting system.

- Key features:

- Direct link between sales orders, invoices, and revenue recognition schedules.

- Support for multi-currency and multi-subsidiary global consolidation.

- Automated SSP calculations based on historical transaction data.

- “Fair value” price lists for complex multi-element bundles.

- Detailed disclosure reporting required for public company audits.

- Native integration with NetSuite’s billing and general ledger modules.

- Pros:

- Eliminates the need for “data syncing” between a separate RevRec tool and the ERP.

- Extremely scalable; the system grows with the company from startup to IPO.

- Cons:

- Requires a NetSuite subscription, which is a major financial commitment.

- Customizing complex revenue rules often requires “SuiteScript” programming expertise.

- Security & compliance: SOC 1/SOC 2, PCI DSS, HIPAA, and ISO 27001. Industry-leading security backed by Oracle.

- Support & community: Massive global network of consultants; “SuiteAnswers” knowledge base and a huge user community.

4 — Sage Intacct Revenue Management

Sage Intacct offers one of the most powerful and flexible revenue recognition modules available for the mid-market. It is widely praised by CFOs for its “dimensional” reporting and audit-readiness.

- Key features:

- Automated revenue triggers based on dates, events, or percentage of completion.

- Sophisticated handling of “unbilled” vs. “deferred” revenue.

- Virtual “audit-ready” folders for every revenue contract.

- Automated dual-reporting for internal and external (GAAP) books.

- Seamless integration with Salesforce CPQ.

- Advanced forecasting that projects future revenue based on current contracts.

- Pros:

- Excellent for companies that need to report revenue by different “dimensions” (department, location, project).

- Recognized by the AICPA as the preferred provider of financial applications.

- Cons:

- The user interface, while functional, is not as visually modern as some SaaS startups.

- Advanced modules come with significant additional licensing costs.

- Security & compliance: SOC 1 & 2 Type II, GDPR, and HIPAA compliant.

- Support & community: Strong community of accounting professionals; extensive help documentation and regional user groups.

5 — Chargebee (RevRec Module)

Chargebee, primarily known as a subscription billing leader, has significantly bolstered its revenue recognition capabilities through the acquisition of RevLock. It offers a very “SaaS-forward” approach to revenue automation.

- Key features:

- Automated “five-step model” compliance out of the box.

- Real-time “Deferred Revenue” and “Waterfall” reports.

- Deep integration with Chargebee Billing for seamless data flow.

- Automated handling of mid-cycle upgrades, downgrades, and refunds.

- Support for non-subscription revenue (one-time fees, professional services).

- Integrated “SSP” (Standalone Selling Price) management.

- Pros:

- The most “user-friendly” experience for pure-play SaaS companies.

- Much more affordable and faster to deploy than enterprise-tier engines.

- Cons:

- Not as well-suited for non-SaaS industries (like heavy manufacturing).

- Lacks some of the “deep” multi-book accounting found in NetSuite or Zuora.

- Security & compliance: SOC 1 & 2 Type II, GDPR, ISO 27001, and PCI DSS Level 1.

- Support & community: Excellent chat and email support; robust “Chargebee Academy” for self-paced learning.

6 — Recurly (Revenue Recognition)

Recurly is a subscription management platform that has expanded into the RevRec space to provide a unified experience for B2C and B2B recurring revenue businesses.

- Key features:

- Automated revenue schedules generated directly from subscription events.

- Support for “point-in-time” vs. “over-time” revenue recognition.

- Integrated deferred revenue and revenue waterfall reporting.

- Automated handling of sales tax and its impact on revenue.

- Simple “out-of-the-box” setup for standard SaaS models.

- Exportable audit-ready data for external accounting firms.

- Pros:

- Great for companies that want an all-in-one billing and RevRec solution.

- Very high reliability and uptime for high-volume consumer subscriptions.

- Cons:

- Limited flexibility for highly complex, bespoke enterprise contracts.

- Revenue recognition is an add-on, increasing the total cost of ownership.

- Security & compliance: PCI DSS Level 1, SOC 2 Type II, and GDPR compliant.

- Support & community: Responsive customer success team and a well-maintained technical blog and documentation.

7 — Ordway

Ordway is an agile “billing and revenue automation” platform designed to simplify the mid-market’s transition from spreadsheets to automated systems.

- Key features:

- Converged billing and revenue recognition engine.

- Automated SSP calculations and allocation across contract elements.

- Support for multi-currency and complex global tax scenarios.

- “What-if” scenario modeling for revenue forecasting.

- Deep integration with Salesforce and various mid-market ERPs.

- Automated “true-up” entries for usage-based billing adjustments.

- Pros:

- Extremely flexible; can handle “weird” billing and revenue models that larger systems struggle with.

- Very fast implementation and a modern, high-performance UI.

- Cons:

- Smaller third-party consultant ecosystem compared to NetSuite or SAP.

- Brand recognition is lower, which may require more “internal selling” to stakeholders.

- Security & compliance: SOC 1 & 2 Type II, GDPR, and PCI DSS.

- Support & community: High-touch personalized support; focuses heavily on client success during the implementation phase.

8 — Softrax

Softrax is one of the veterans of the revenue recognition space, offering a robust “Revenue Manager” solution that is designed to sit alongside any existing billing system.

- Key features:

- Massive library of pre-configured revenue recognition “templates.”

- Deep support for IFRS 15, ASC 606, and the upcoming revisions.

- Ability to handle “bill-and-hold” and “consignment” revenue scenarios.

- Sophisticated multi-book accounting for global reporting.

- Automated contract “linkage” across different sales systems.

- Enterprise-grade audit trails and permission controls.

- Pros:

- Decades of experience in the “hardest” accounting edge cases.

- Very strong for organizations that have multiple legacy billing systems that need a single RevRec engine.

- Cons:

- The interface can feel significantly dated and “legacy” compared to modern SaaS.

- Steep learning curve for the administrative users.

- Security & compliance: SOC 1 & 2 Type II, ISO 27001, and robust data privacy controls.

- Support & community: Highly professional enterprise support; focuses on long-term partnerships with clients.

9 — BillingPlatform

BillingPlatform is a high-growth “Enterprise Monetization” platform that includes a powerful, automated revenue recognition module. It is designed for businesses that need to move fast and change models frequently.

- Key features:

- Cloud-native, high-performance engine for high-volume transactions.

- Automated allocation of revenue across “performance obligations.”

- Flexible forecasting based on both contracted and usage-based revenue.

- Integrated sub-ledger that summarizes data for the general ledger.

- “No-code” configuration for revenue rules and schedules.

- Support for complex multi-currency and multi-jurisdiction tax.

- Pros:

- Excellent for companies that shift between subscription and usage-based models frequently.

- The “no-code” approach allows the finance team to adjust rules without IT help.

- Cons:

- Can be overly complex for companies with static, simple subscription models.

- Premium pricing reflects its status as a high-end enterprise solution.

- Security & compliance: SOC 1 & 2, PCI DSS Level 1, HIPAA, and GDPR compliant.

- Support & community: Global 24/7 support; robust technical documentation and professional service offerings.

10 — Maxio (formerly SaaSOptics + Chargify)

Maxio is specifically built for the B2B SaaS market. It combines robust subscription management with a “RevRec-first” approach to financial operations.

- Key features:

- Automated ASC 606 revenue recognition for B2B SaaS contracts.

- Integrated “Revenue Waterfall” and “Deferred Revenue” reporting.

- GAAP-compliant financials that are ready for venture capital audits.

- Automated “Moment-in-Time” revenue triggers for professional services.

- Native integrations with QuickBooks, Xero, and Sage Intacct.

- Comprehensive SaaS metrics (MRR, LTV, CAC) tied to revenue data.

- Pros:

- The best “value for money” for growing B2B SaaS startups.

- Specifically designed to make companies “audit-ready” for their next funding round.

- Cons:

- Not suitable for businesses outside the B2B SaaS or professional services realm.

- Reporting is focused on SaaS metrics, which may not translate to traditional retail or manufacturing.

- Security & compliance: SOC 2 Type II, GDPR, and modern encryption standards.

- Support & community: Strong community of SaaS founders and finance leaders; excellent educational content.

Comparison Table

| Tool Name | Best For | Platform(s) Supported | Standout Feature | Rating (Gartner / TrueReview) |

| Zuora RevPro | Large Enterprise | Cloud / Hybrid | Sophisticated SSP Calculator | 4.4 / 5 |

| RightRev | Salesforce Users | Salesforce Native | Quote-to-Revenue Automation | 4.7 / 5 |

| NetSuite ARM | NetSuite ERP Users | Cloud-Native | Native ERP Integration | 4.3 / 5 |

| Sage Intacct | Mid-Market Finance | Cloud-Native | Dimensional Reporting | 4.6 / 5 |

| Chargebee | Pure-Play SaaS | Cloud-Native | User-Friendly SaaS Workflows | 4.5 / 5 |

| Recurly | B2C Subscriptions | Cloud-Native | Automated Tax Linkage | 4.2 / 5 |

| Ordway | Agile Mid-Market | Cloud-Native | Converged Billing Engine | 4.6 / 5 |

| Softrax | Legacy/Multi-System | Cloud / Hybrid | Deep Regulatory Library | 4.1 / 5 |

| BillingPlatform | High-Volume/Usage | Cloud-Native | No-Code Configuration | 4.5 / 5 |

| Maxio | B2B SaaS Startups | Cloud-Native | VC Audit-Ready GAAP Books | 4.7 / 5 |

Evaluation & Scoring of Revenue Recognition Software

Choosing a revenue recognition tool is a high-stakes decision. To help you evaluate objectively, we have developed a weighted scoring rubric that focuses on the most critical factors for long-term success.

| Category | Weight | Evaluation Criteria |

| Core Features | 25% | Automated ASC 606/IFRS 15 steps, waterfall reporting, SSP management. |

| Ease of Use | 15% | Intuitiveness of the UI, clarity of the dashboard, and ease of rule setup. |

| Integrations | 15% | Native connectors for CRM (Salesforce) and ERP (NetSuite, Oracle, SAP). |

| Security & Compliance | 10% | SOC 2 certifications, GDPR, audit trail quality, and SSO support. |

| Performance & Reliability | 10% | Uptime, system speed during high-volume periods, and data accuracy. |

| Support & Community | 10% | Documentation quality, support response time, and user peer groups. |

| Price / Value | 15% | Total cost of ownership relative to the efficiency gains and audit protection. |

Which Revenue Recognition Software Tool Is Right for You?

The “right” tool depends more on your technical debt and future goals than any single feature.

- Solo Users vs. SMBs: Small businesses with simple subscriptions should look at Chargebee or Maxio. These platforms offer the best “speed to value” and handle the basic RevRec needs without requiring a dedicated accounting team.

- Mid-Market Companies: If you already use Sage Intacct or NetSuite, the native RevRec modules are usually the most efficient choice to avoid integration headaches. If you are a Salesforce-heavy shop, RightRev offers a superior, native experience.

- Large Enterprises: For organizations with massive transaction volumes and global footprints, Zuora RevPro or BillingPlatform are the heavyweights. They offer the industrial-strength processing needed for complex, multi-system environments.

- Budget-Conscious vs. Premium: Maxio and Chargebee offer the most transparent, mid-market pricing. On the premium side, NetSuite and Zuora represent a significant investment but offer unmatched audit protection and scalability.

- Integration and Scalability Needs: Always prioritize a tool that has a “certified” integration with your General Ledger. If the data doesn’t flow perfectly into your monthly close, the tool is not doing its job.

- Security and Compliance Requirements: If you are a public company (or planning an IPO), you must choose a system with robust SOC 1 and SOC 2 Type II reports to satisfy your external auditors.

Frequently Asked Questions (FAQs)

1. Why can’t I just use Excel for revenue recognition?

While you can, it is extremely risky. Spreadsheets lack an audit trail, are prone to human formula errors, and cannot easily handle “contract modifications” (like a customer upgrading mid-month). In an audit, spreadsheets are often the first thing flagged as a “material weakness.”

2. What is the difference between Billing and Revenue Recognition?

Billing is the act of sending an invoice and collecting cash. Revenue Recognition is the accounting act of reporting that income as “earned” in your financial statements. Often, you bill for a year in advance, but you must recognize that revenue monthly over 12 months.

3. Do these tools help with ASC 606 and IFRS 15?

Yes, that is their primary purpose. They automate the 5-step model, ensuring that transaction prices are allocated correctly across performance obligations and reported in the correct periods according to the law.

4. How long does implementation take?

For mid-market tools like Maxio or RightRev, implementation can take 4–8 weeks. For enterprise-scale systems like Zuora or NetSuite ARM, expect a 4–9 month journey involving significant data migration and testing.

5. Can these tools handle usage-based billing?

Yes, most modern RevRec tools (especially BillingPlatform and Ordway) are designed specifically to handle usage data, automatically calculating “true-ups” and recognizing revenue as the service is consumed.

6. Do I need to switch my ERP to use RevRec software?

Not necessarily. Tools like Zuora RevPro, Softrax, and RightRev are “ERP-agnostic,” meaning they can sit on top of your existing accounting system and push the journal entries in via API or CSV.

7. How do these tools handle “SSP” (Standalone Selling Price)?

Most RevRec tools have built-in SSP calculators that analyze your historical sales data to determine the “fair value” of individual items in a bundle, ensuring revenue is allocated correctly even if you gave a discount on one item.

8. Will this software help with my annual audit?

Enormously. These systems provide a “locked” audit trail where every transaction can be traced back to the original contract. Auditors love these systems because they provide “system-generated” reports that are much more reliable than manual files.

9. Are these tools secure?

Top-tier RevRec vendors invest millions in security. Look for SOC 2 Type II certification, which means a third-party firm has audited their security controls and found them effective.

10. What is a “Revenue Waterfall” report?

It is a critical report that shows your actual recognized revenue for past months and projects your expected revenue for future months based on your current active contracts. It is the single most important report for a SaaS CFO.

Conclusion

The transition from manual revenue recognition to automated software is a “rite of passage” for any growing enterprise. The complexity of modern business standards like ASC 606 has made manual processing a liability. Whether you choose the enterprise power of Zuora, the native ERP integration of NetSuite, or the agile, SaaS-first approach of RightRev or Maxio, the goal remains the same: audit-proof accuracy and real-time visibility.

As we move deeper into 2026, the businesses that succeed will be those that view revenue recognition not just as a compliance checkbox, but as a strategic tool for forecasting the future.